The Gravestone Doji is a Japanese candlestick in which the open and close price of the candle is at the same level or is very close to the same level.

A Doji candle that opens and closes at or near its low. The candle ends up having a long upper shadow and no body.

If it has a long upper shadow, it signals a bearish reversal. When it appears at the top of an uptrend, it is considered a reversal signal.

This pattern is more bearish than a shooting star.

To identify a Gravestone Doji, look for the following criteria:

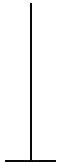

- The Gravestone Doji has a long upper shadow but no lower shadow, and it resembles an upside-down capital letter

To help you remember, think about how a real gravestone remains anchored to the ground. The horizontal line of the Gravestone pattern is fixed to the bottom.

This is different from the Dragonfly Doji where its horizontal line is fixed to the top.

Meaning

A Gravestone Doji is bearish.

A Gravestone Doji signals that the price opened at the low of the session. There was a great rally during the session, and then the price closed at the low of the session.

The result is that the open, low, and close are all the same (or about the same) price.

This candlestick pattern’s presence is most significant when it appears after an uptrend, preceded by bullish candlesticks. It suggests that the uptrend may be coming to an end.

Dojis are trend reversal indicators, especially if they appear after an uptrend or downtrend. A basic Doji signifies indecision, but a Gravestone Doji implies that the market has decided to be bearish.

When you see a Gravestone Doji candlestick after a strong uptrend, it is likely that a trend reversal is going to happen.

Once you identify a Gravestone Doji, a simple strategy can be to open a short position below the low of the Doji

Your trade should only trigger the low of the Doji breaks down. If the low of the Gravestone Doji holds, the price may resume its upward trend.

If this article seems useful to your then please click the like button below. You can also share your valuable feedback or ask questions in the below comment section. Also, subscribe to our newsletter for trading-related updates.