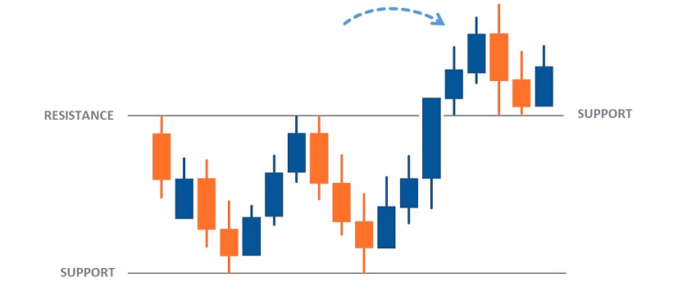

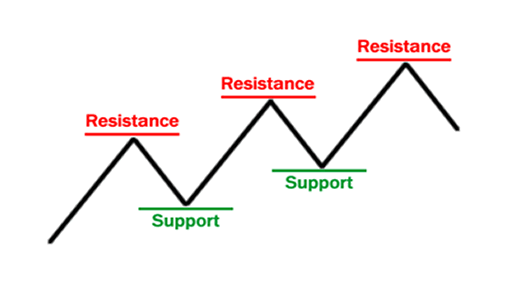

A support level is a concept in technical analysis, indicating when an asset has reached a price level that market participants are unwilling to continue selling, which causes the price to stop falling.

Support is a price level where downward movement may be restrained by accumulated demand at or around that price level.

A support level is a price level at which an asset may find difficulty falling below as traders look to buy around that level.

More and more buyers are active the closer the price gets to the support level.

Support can be described as:

- A price level at which a currency has trouble falling below.

- A price level at which buying is expected to take place.

Usually, the markets prove unwilling to let an asset drop below its support level, with buyers stepping in to raise the asset’s price higher again.

That makes them the opposite of resistance levels, which is a price level at which the markets prove unwilling to let an asset’s price rise any higher.

If an asset does move below its support level, then that support level has “been broken“.

Knowing where an asset’s support and resistance levels are can help traders choose the best time to enter a market, as well as where to put stops and limits.

If this article seems useful to your then please click the like button below. You can also share your valuable feedback or ask questions in the below comment section. Also, subscribe to our newsletter for trading-related updates.