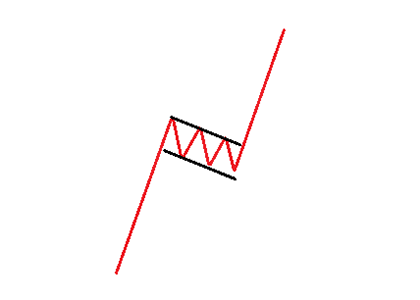

A bull flag is a bullish chart pattern formed by two rallies separated by a brief consolidating retracement period.

The flagpole forms on an almost vertical price spike as sellers get blindsided from the buyers, then a pullback that has parallel upper and lower trendlines, which form the flag.

The initial rally comes to an end through some profit-taking and the price forms a tight range making slightly lower lows and lower highs.

Eventually, the price peaks and forms an orderly pullback where the highs and lows are literally parallel to each other, forming a tilted rectangle.

This illustrates that there is still support in the market although the unwinding of some large long positions and traders entering short positions looking for a reversal forces the price to drift in a downwards direction.

During the consolidation, traders should be prepared to take action should price break up through the upper range level and/or make a new high as this indicates the bulls are in control again to push another rally.

Upper and lower trendlines are plotted to reflect the parallel diagonal nature.

The breakout forms when the upper resistance trend line breaks again as prices surge back towards the high of the formation and explode through to trigger another breakout and uptrend move.

The sharper the spike on the flagpole, the more powerful the bull flag can be.

The bear flag is an upside-down version of the bull flag.

If this article seems useful to your then please click the like button below. You can also share your valuable feedback or ask questions in the below comment section. Also, subscribe to our newsletter for trading-related updates.