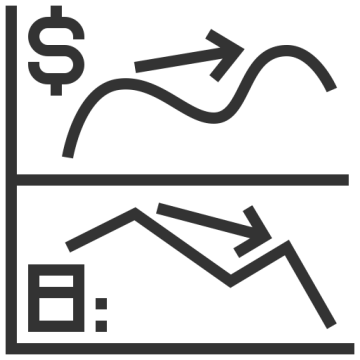

What if there was a low-risk way to sell near the top or buy near the bottom of a trend?

What if you were already in a long position and you could know ahead of time the perfect place to exit instead of watching your unrealized gains, a.k.a your potential Aston Martin down payment or future Christian Louboutin high heels, vanish before your eyes because your trade reverses direction?

What if you believe a currency pair will continue to fall but would like to short at a better price or a less risky entry?

Well, guess what? There is a way!

It’s called divergence trading.

In a nutshell, divergence can be seen by comparing price action and the movement of an indicator.

It doesn’t really matter what indicator you use.

You can use RSI, MACD, Stochastic, CCI, etc.

The great thing about divergences is that you can use them as a leading indicator, and after some practice, it’s not too difficult to spot.

When traded properly, you can be profitable with divergences.

The best thing about divergences is that you’re usually buying near the bottom or selling near the top.

This makes the risk on your trades very small relative to your potential reward.

Cha-ching!

Trading Divergences

Just think “higher highs” and “lower lows“.

Price and momentum normally move hand in hand like avocado and toast, Hansel and Gretel, Ryu and Ken, Batman and Robin, Jay Z and Beyonce, Kobe and Shaq, salt and pepper…You get the point.

If the price is making higher highs, the oscillator should also be making higher highs. If the price is making lower lows, the oscillator should also be making lower lows.

If they are NOT, that means price and the oscillator are diverging from each other. And that’s why it’s called “divergence.”

Divergence trading is an awesome tool to have in your toolbox because divergences signal to you that something fishy is going on and that you should pay closer attention.

Using divergence trading can be useful in spotting a weakening trend or reversal in momentum. Sometimes you can even use it as a signal for a trend to continue!

There are TWO types of divergence:

- Regular

- Hidden

In this grade, we will teach you how to spot these divergences and how to trade them.

We’ll even have a sweet surprise for you at the end.

Regular Divergence

What is a regular divergence?

A regular divergence is used as a possible sign for a trend reversal.

There are two types of regular divergences: bullish and bearish.

Regular Bullish Divergence

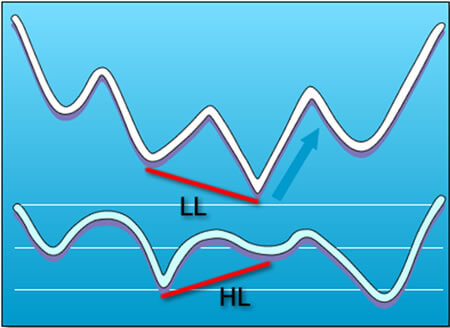

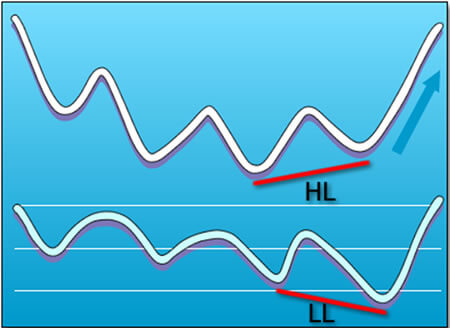

If the price is making lower lows (LL), but the oscillator is making higher lows (HL), this is considered to be regular bullish divergence.

This normally occurs at the end of a DOWNTREND.

After establishing a second bottom, if the oscillator fails to make a new low, it is likely that the price will rise, as price and momentum are normally expected to move in line with each other.

Below is an image that portrays a regular bullish divergence.

Regular Bearish Divergence

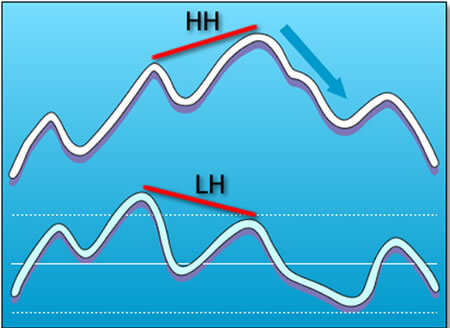

Now, if the price is making a higher high (HH), but the oscillator is lower high (LH), then you have regular bearish divergence.

This type of divergence can be found in an UPTREND.

After price makes that second high, if the oscillator makes a lower high, then you can probably expect the price to reverse and drop.

In the image below, we see that the price reverses after making the second top.

As you can see from the images above, the regular divergence is best used when trying to pick tops and bottoms.

You are looking for an area where the price will stop and reverse.

The oscillator signals to us that momentum is starting to shift and even though the price has made a higher high (or lower low), chances are that it won’t be sustained.

Now that you’ve got a hold on regular divergence, it’s time to move and learn about the second type of divergence….hidden divergence.

Don’t worry, it’s not super concealed like the Chamber of Secrets and it’s not that tough to spot.

The reason it’s called “hidden” is that it’s hiding inside the current trend.

We’ll explain more in the next section. Read on!

Hidden Divergence

We covered regular divergences in the previous lesson, now let’s discuss what hidden divergences are.

What’s a hidden divergence?

Divergences not only signal a potential trend reversal but can also be used as a possible sign for a trend continuation (price continues to move in its current direction).

Always remember, the trend is your friend, so whenever you can get a signal that the trend will continue, then good for you!

Hidden bullish divergence happens when the price is making a higher low (HL), but the oscillator is showing a lower low (LL).

Hidden Bullish Divergence

This can be seen when the pair is in an UPTREND.

Once price makes a higher low (HL), look and see if the oscillator does the same.

If it doesn’t and makes a lower low (LL), then we’ve got some hidden divergence in our hands.

Hidden Bearish Divergence

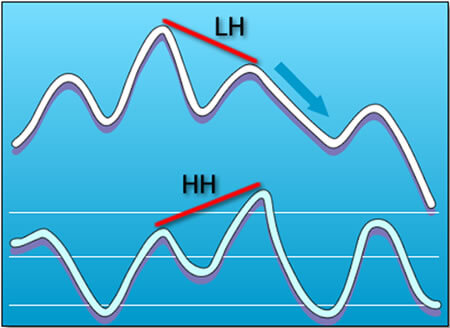

Lastly, we’ve got hidden bearish divergence.

This occurs when price makes a lower high (LH), but the oscillator is making a higher high (HH).

By now you’ve probably guessed that this occurs in a DOWNTREND.

When you see hidden bearish divergence, chances are that the pair will continue to shoot lower and continue the downtrend.

Let’s recap what you’ve learned so far about hidden divergence.

If you’re a trend follower, then you should dedicate some time to spot some hidden divergence.

If you do happen to spot it, it can help you jump in the trend early.

Sounds good, yes?

Keep in mind that regular divergences are possible signals for trend reversals while hidden divergences signal trend continuation.

- Regular divergences = signal possible trend reversal

- Hidden divergences = signal possible trend continuation

In the next lesson, we’ll show you some real-world examples of when divergences existed and how you could have traded them.

Divergence Trading

Now it’s time to put those Jedi divergence mind tricks to work and force the markets to give you some pips!

In this lesson, we’ll show you some examples of when there was a divergence between price and oscillator movements.

- Regular Divergence

First up, let’s take a look at regular divergence.

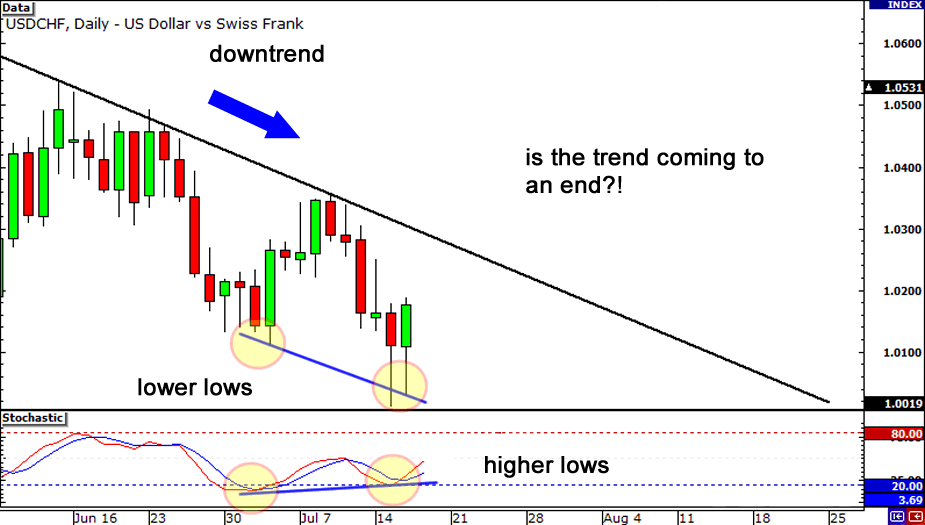

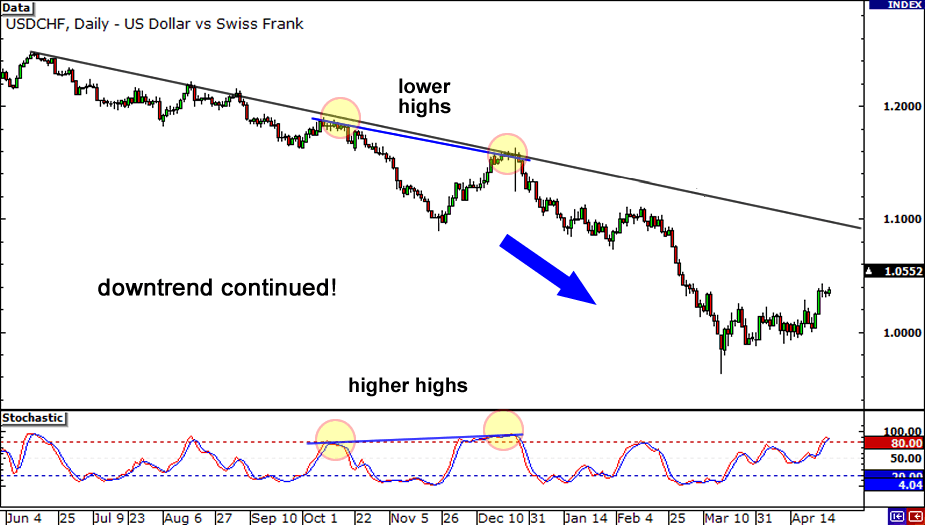

Below is a daily chart of USD/CHF.

We can see from the falling trend line that USD/CHF has been in a downtrend.

However, there are signs that the downtrend will be coming to an end.

While the price has registered lower lows, the Stochastic (our indicator of choice) is showing a higher low.

Something smells fishy here.

Is the reversal coming to an end? Is it time to buy this sucker?

If you had answered yes to that last question, then you would have found yourself in the middle of the Caribbean, soaking up margaritas, as you would have been knee-deep in your pip winnings!

It turns out that the divergence between the Stochastic and price action was a good signal to buy.

Price broke through the falling trend line and formed a new uptrend.

If you had bought near the bottom, you could have made more than a thousand pips, as the pair continued to shoot even higher in the following months.

Now can you see why it rocks to get in on the trend early?!

Before we move on, did you notice the tweezer bottoms that formed on the second low?

Keep an eye out for other clues that a reversal is in place. This will give you more confirmation that a trend is coming to an end, giving you even more reason to believe in the power of divergences!

2. Hidden Divergence

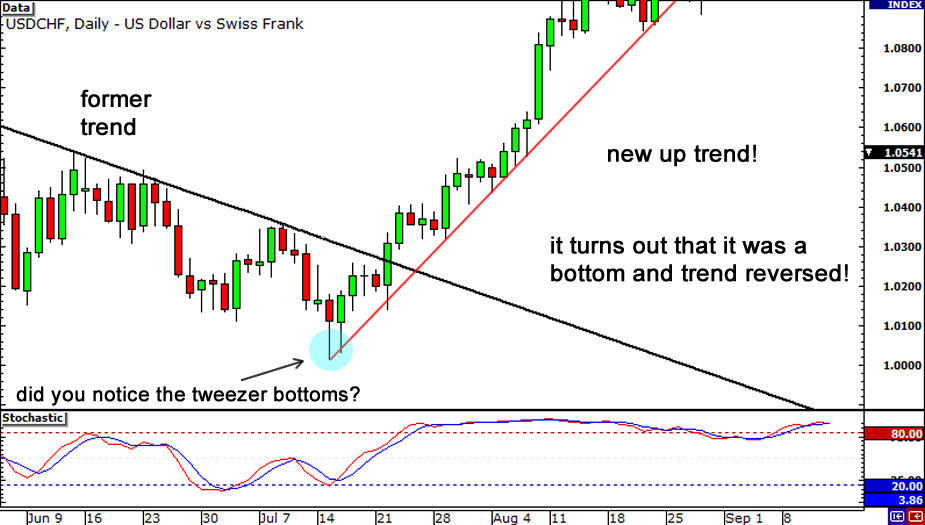

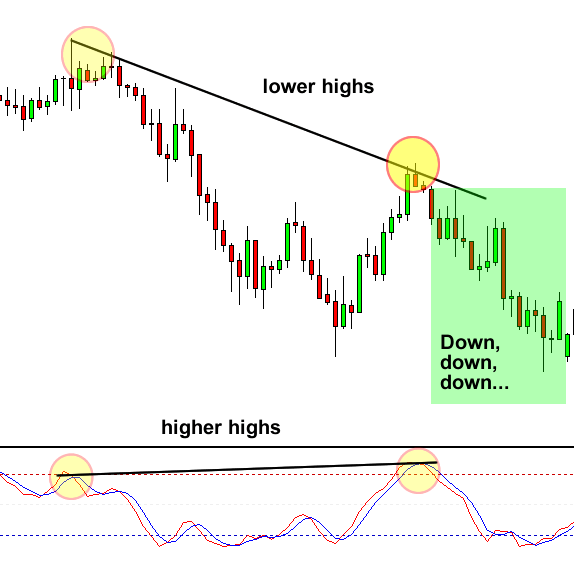

Next, let’s take a look at an example of some hidden divergence.

Once again, let’s hop on to the daily chart of USD/CHF.

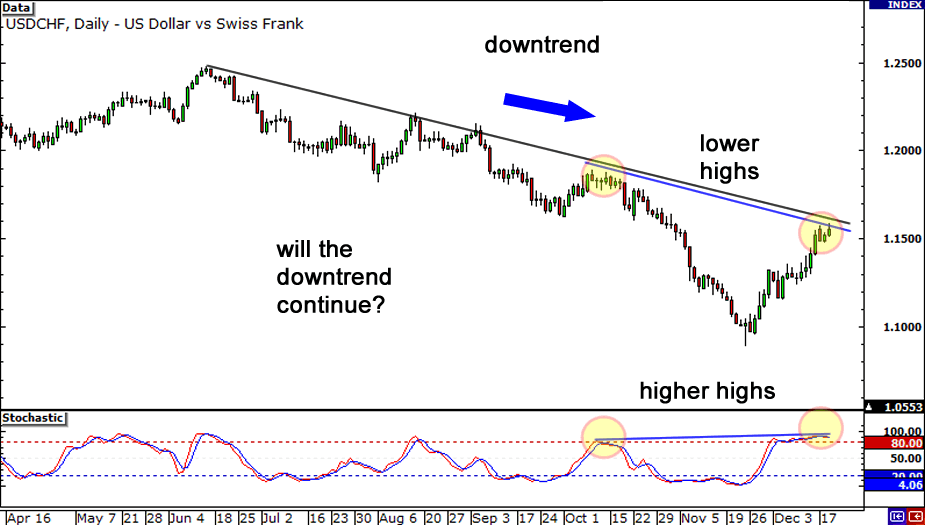

Here we see that the pair has been in a downtrend.

Notice how price has formed a lower high but the stochastic is printing higher highs.

According to our notes, this is a hidden bearish divergence!

Hmmm, what should we do? Time to get back in the trend?

Well, if you ain’t sure, you can sit back and watch on the sidelines first.

If you decided to sit that one out, you might be as bald as Professor Xavier now because you pulled out all your hair.

Why?

Well, the trend continued!

Price bounced from the trend line and eventually dropped almost 2,000 pips!

Imagine if you had spotted the divergence and seen that as a potential signal for a continuation of the trend?

Not only would you be sipping those margaritas in the Caribbean, but you’d also have your own pimpin’ yacht to boot!

Avoid Entering Too Early

While using divergences is a great tool to have in your trading toolbox, there are times when you might enter too early because you didn’t wait for more confirmation.

If you keep entering too early, you’ll keep getting stopped out (you do use stops right?!) and you’ll slowly rack up losses.

And you know what happens when even small losses accumulate, you’ll end up broke.

You’ll end up with a divergence between your mind and your wallet regarding your wealth.

Below are a couple of tricks of the (divergence) trade that you can make use of so that you have more confirmation that the divergence will work out in your favor.

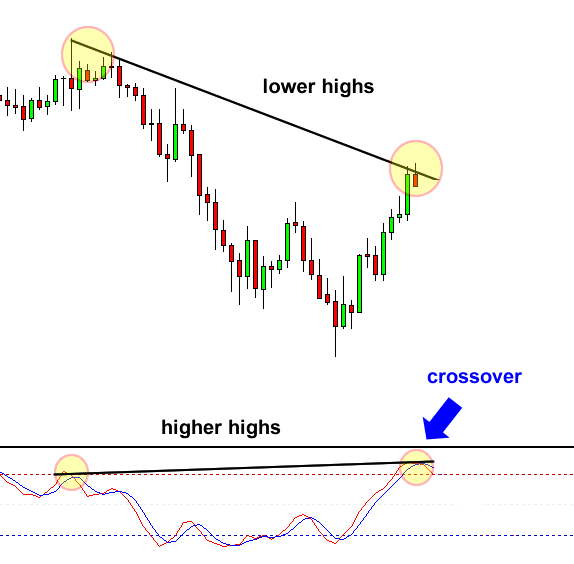

1. Wait for an indicator crossover.

This ain’t so much a trick as it is a rule. Just wait for a crossover of the momentum indicator.

This would indicate a potential shift in momentum from buying to selling or vice versa.

The main reasoning behind this is that you are waiting for top or bottom and these can’t be formed unless a crossover is made!

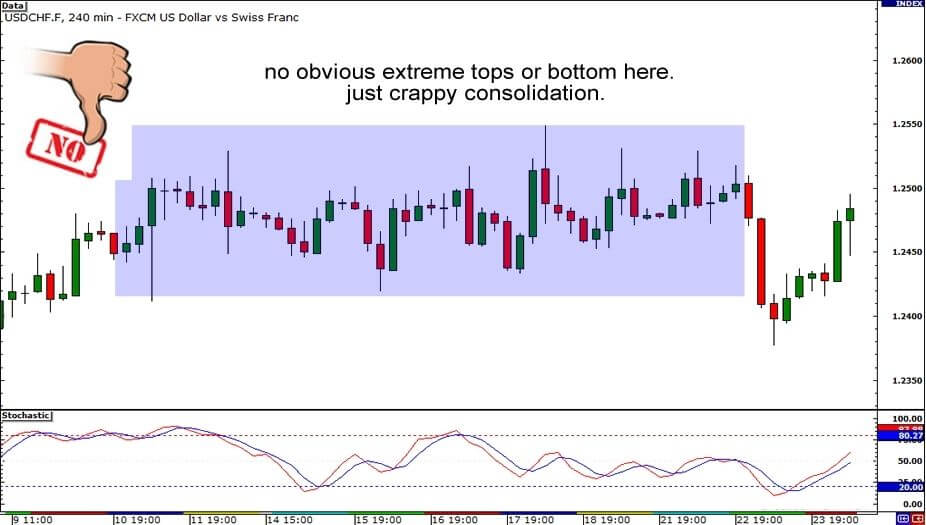

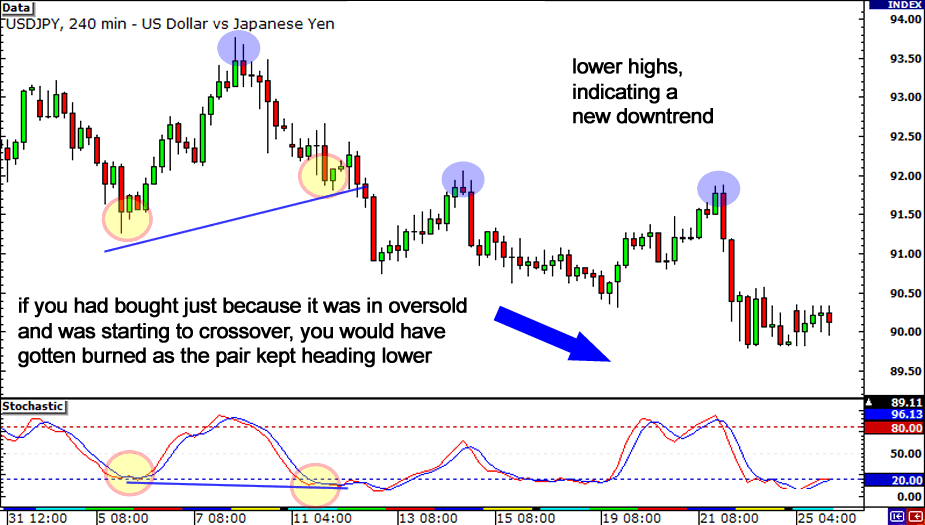

In the chart above, the pair showed lower highs while the Stochastic already made higher highs. Now that’s a bearish divergence there and it sure is tempting to short right away.

In the chart above, the pair showed lower highs while the Stochastic already made higher highs. Now that’s a bearish divergence there and it sure is tempting to short right away.

But, you know what they say, patience is a virtue.

It’d be better to wait for Stochastic to make a downward crossover as confirmation that the pair is indeed headed down.

A couple of candles later, the Stochastic did make that crossover. Playing that bearish divergence would’ve been piptastic!

What’s the main point here? Just be patient! Don’t try to jump the gun because you don’t quite know when momentum will shift!

If you aren’t patient, you might just get burned as one side keeps dominating!

2. Wait for the indicator to move out of overbought/oversold territory.

Another trick would be to wait for momentum highs and lows to hit overbought and oversold conditions, and wait for the indicator to move out of these conditions.

The reason for doing this is similar to that of waiting for a crossover – you really don’t have any idea when momentum will begin to shift.

Let’s say you’re looking at a chart and you notice that the Stochastic has formed a new low while the price hasn’t.

You may think that it’s time to buy because the indicator is showing oversold conditions and divergence has formed.

However, selling pressure may remain strong and the price continues to fall and make a new low.

You would have been pretty bummed out as the trend didn’t continue.

In fact, a new downtrend is probably in place as the pair is now forming lower highs. And if you were stubborn, you might have missed out on this down move too.

If you had waited patiently for more confirmation that the divergence had formed, then you could have avoided losing and realized that a new trend was developing.

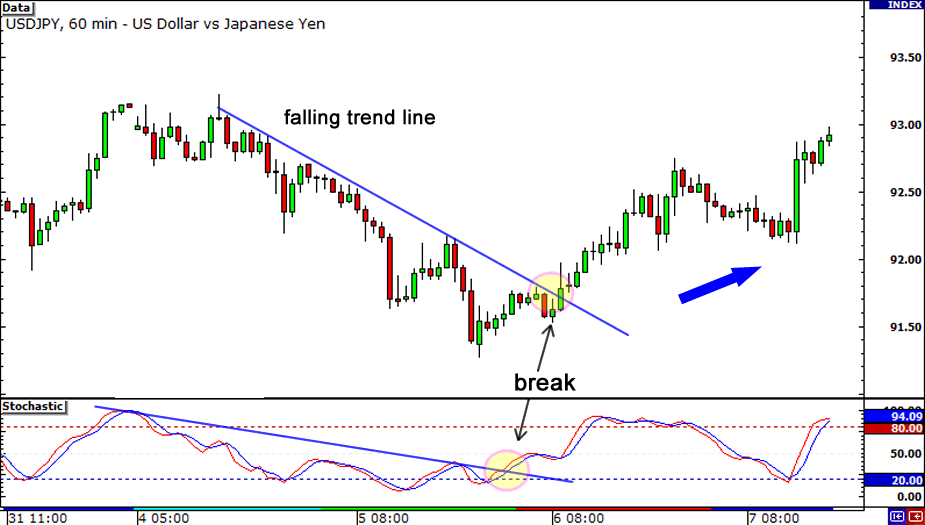

3. Draw trend lines on the momentum indicator itself.

This might sound a little ridiculous since you would normally draw trend lines only on price action.

But this is a nifty lil’ trick that we wanna share with you. After all, it doesn’t hurt to have another weapon in the holster right? You never know when you might use it!

This trick can be particularly useful especially when looking for reversals or breaks from a trend. When you see that price is respecting a trend line, try drawing a similar trend line on your indicator.

You may notice that the indicator will also respect the trend line.

If you see both price action and the momentum indicator break their respective trend lines, it could signal a shift in power from buyers to sellers (or vice versa) and that the trend could be changing.

9 Rules for Divergences Trading

Divergences are used by traders in an attempt to determine if a trend is getting weaker, which may lead to a trend reversal or continuation.

Before you head out there and start looking for potential divergences, here are nine cool rules for trading divergences.

Learn ’em, memorize ’em (or keep coming back here), apply ’em to help you make better trading decisions.

Ignore them and go broke.

In order for a divergence to exist, the price must have either formed one of the following:

- Higher high than the previous high

- Lower low than the previous low

- Double Top

- Double Bottom

Don’t even bother looking at an indicator unless ONE of these four price scenarios has occurred.

If not, you ain’t trading a divergence, buddy.You’re just imagining things. Immediately go see your optometrist and get some new glasses.

2. Draw lines on successive tops and bottoms

Okay now that you got some action (recent price action that is), look at it. Remember, you’ll only see one of four things: a higher high, a flat high, a lower low, or a flat low.

Now draw a line backward from that high or low to the previous high or low. It HAS to be on successive major tops/bottom.

If you see any little bumps or dips between the two major highs/lows, do what you do when your significant other shouts at you – ignore it.

3. Connect TOPS and BOTTOMS only

Once you see two swing highs are established, you connect the TOPS.If two lows are made, you connect the BOTTOMS.

4. Keep Your Eyes on the Price

So you’ve connected either two tops or two bottoms with a trend line. Now look at your preferred technical indicator and compare it to price action. Whichever indicator you use, remember you are comparing its TOPS or BOTTOMS.

Some indicators such as MACD or Stochastic have multiple lines all up on each other like teenagers with raging hormones. Don’t worry about what these kids are doing.

5. Be Consistent With Your Swing Highs and Lows

If you draw a line connecting two highs on price, you MUST draw a line connecting the two highs on the indicator as well. Ditto for lows also.

If you draw a line connecting two lows on price, you MUST draw a line connecting two lows on the indicator. They have to match!

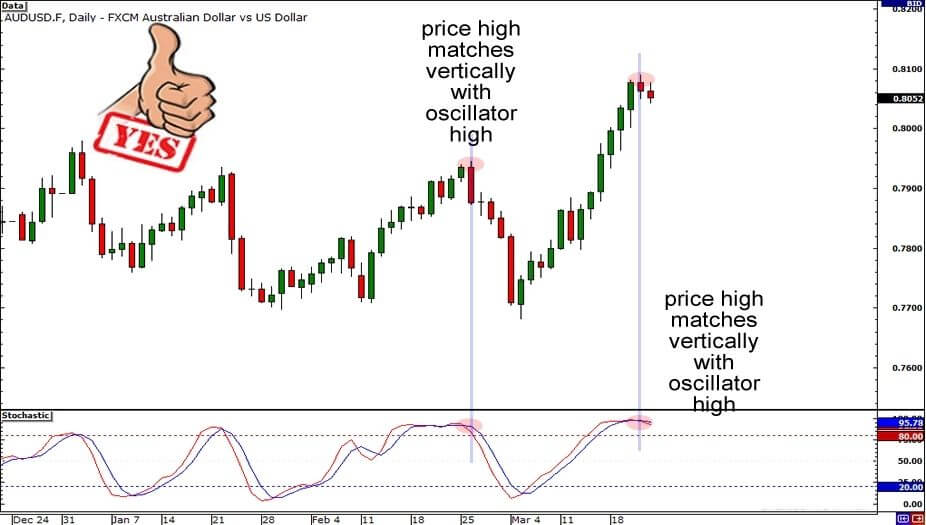

6. Keep Price and Indicator Swings in Vertical Alignment

The highs or lows you identify on the indicator MUST be the ones that line up VERTICALLY with the price highs or lows.

It’s just like picking out what to wear to the club, You gotta be fly and matchin’ yo!Maintain vertical alignment with the PRICE’s swing highs and lows with the INIDCATOR’s swing highs and lows.

7. Watch the Slopes

Divergence only exists if the SLOPE of the line connecting the indicator tops/bottoms DIFFERS from the SLOPE of the line connection price tops/bottoms.

8. If the ship has sailed, catch the next one.

If you spot divergence but the price has already reversed and moved in one direction for some time, the divergence should be considered played out.

You missed the boat this time. All you can do now is wait for another swing high/low to form and start your divergence search over.

9. Take a Step Back

Divergence signals tend to be more accurate on the longer time frames. You get fewer false signals.

This means fewer trades but if you structure your trade well, then your profit potential can be huge.

Divergences on shorter time frames will occur more frequently but are less reliable.

We advise only look for divergences on 1-hour charts or longer.

Other traders use 15-minute charts or even faster. In those time frames, there’s just too much noise for our taste so we just stay away.

So there you have it!

Nine rules you MUST (should?) follow if you want to seriously consider trading using divergences.

Trust us, you don’t wanna be ignoring these rules. Your account will take more hits than fxbangladesh.com’s Facebook page.

Follow these rules, and you will dramatically increase the chances of a divergence setup leading to a profitable trade.

Now go scan the charts and see if you can spot some divergences that happened in the past as a great way to begin getting your divergence skills up to par!

If this article seems useful to your then please click the like button below. You can also share your valuable feedback or ask questions in the below comment section. Also, subscribe to our newsletter for trading-related updates.