The Falling Three Methods pattern is a bearish continuation pattern that appears in a downtrend.

This Japanese candlestick pattern consists of at least five candlesticks but may include more.

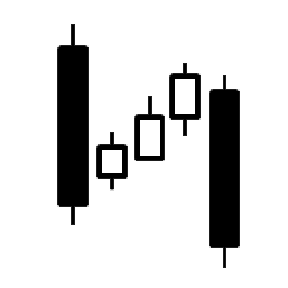

A long black body is followed by three small body candles, each fully contained within the range of the high and low of the first candle. The fifth candle closes at a new low.

Recognition Criteria

The Falling Three Methods pattern includes five candlesticks in total: two long and three short.

Or more specifically: one long, three short, one long.

To identify the Falling Three Methods pattern, look for the following criteria:

- Look for a series of five candles in a downward price trend.

- The first candlestick in this pattern is a dark bearish candlestick with a large real body.

- The first candle will be followed by three or more short white (or green) candles. The next three candlesticks have smaller rising candlesticks that are bullish and light in color. These candlesticks should not exceed the high or the low of the first candlestick.

- The short candles should be followed by another long black candle.

- This last candlestick that completes the pattern must close below the previous candlestick and close lower than the close of the first candlestick.

Meaning

Since this pattern starts with a long black candle, the bears are stronger than the bulls.

After the first candle though, the price pauses for a moment (forming the three short candles in the center, within the range of the first candle).

The bulls aren’t able to push the price above the height of that first long candle, and they are overtaken by the bears.

In the end, the price is driven downward again, creating another long black candle that closes below the first candle.

The Three Methods Pattern

The Three Methods pattern consists of at least five candlesticks but may include more.

The Three Methods pattern is a trend continuation pattern that can appear in an uptrend or a downtrend.

In an uptrend, it is called the Rising Three Methods pattern. In a downtrend, it is called the Falling Three Methods pattern.

If this article seems useful to your then please click the like button below. You can also share your valuable feedback or ask questions in the below comment section. Also, subscribe to our newsletter for trading-related updates.