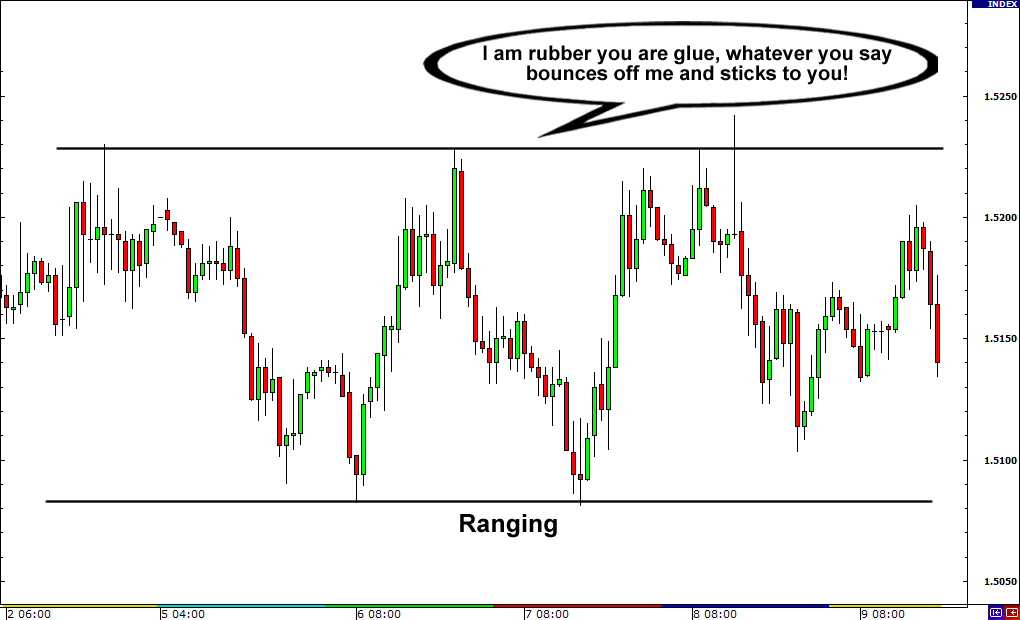

Range is a term used to describe when a price is trading between a defined high and low, moving within these two boundaries without breaking out from them.

The “range” is the difference between a market’s highest and lowest price in a given period.

It is mostly used as an indicator of volatility.

If a market has a wide range, it’s a sign that it was volatile over the period analyzed.

How to Use Range

As with any indicator of volatility, range can be used as a means of measuring a trade’s potential risk.

If a market is trading with a wide range, then the risk associated with trading it will tend to be higher.

It can also be used to identify support and resistance levels

If a market has been trading within a certain range for a long period, then the upper and lower limits of that range can be taken as strong areas of support and resistance.

How to Calculate Range

To calculate a range, you just take the highest price point that is reached in the period you are analyzing and subtract the lowest price point.

For example, GPB/USD hit a high of 1.2090 and a low of 1.2010 on a given trading day. Its range for that day would be 1.2090 – 1.2010 = 90 pips.

If this article seems useful to your then please click the like button below. You can also share your valuable feedback or ask questions in the below comment section. Also, subscribe to our newsletter for trading-related updates.