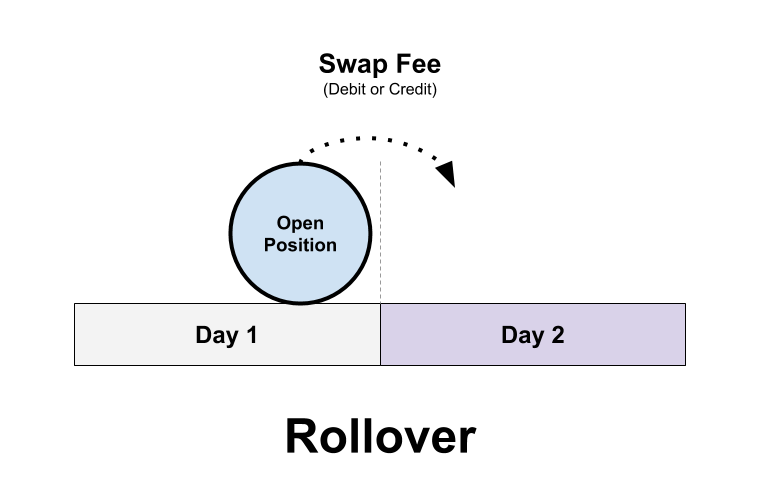

Rollover is the procedure of moving open positions from one trading day to another.

Most brokers and trading platforms perform the rollover automatically by closing any open positions at the end of the day, while simultaneously opening an identical position for the following business day.

During this rollover, a swap is calculated.

A swap is a FEE that is either paid or charged to you at the end of each trading day if you keep your trade open overnight.

If you are paid swap, cash will be added to your Balance.

If you are charged a swap, cash will be deducted from your Balance.

A swap fee is also called an “overnight financing fee” or “overnight financing charge.”

Unless you’re trading huge position sizes, these swap fees are usually small but can add up over time.

For EUR/USD, if swap rates were 0.637/1.05, on a long position of €10,000, you would be charged $1.05 to hold the position overnight.

If you were to sell EUR/USD for €10,000, you would receive $0.64 overnight.

These amounts are then converted back into your base currency.

In the spot forex market, trades must be settled in two business days.

For example, if a trader sells 100,000 pounds on Monday, then the trader must deliver 100,000 pounds on Wednesday unless the position is rolled over.

All open forex positions at the end of the day (5:00 PM New York time) are automatically rolled over to the next settlement date.

The rollover adjustment is simply the accounting of the cost-of-carry on a day-to-day basis.

If this article seems useful to your then please click the like button below. You can also share your valuable feedback or ask questions in the below comment section. Also, subscribe to our newsletter for trading-related updates.