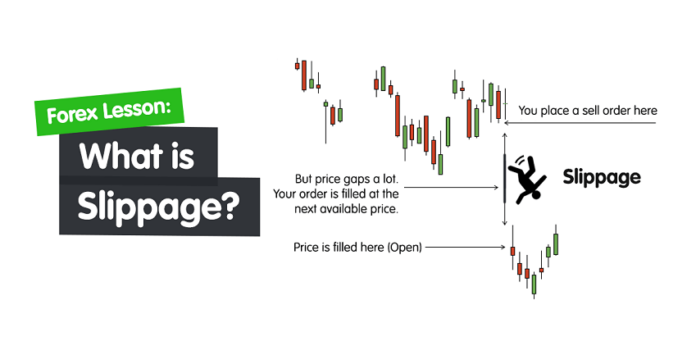

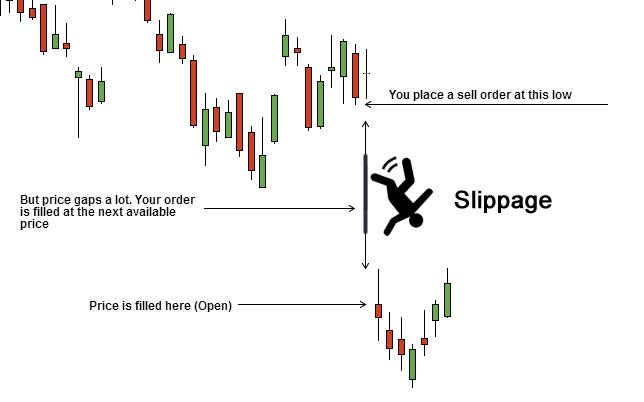

Slippage occurs when an order is filled at a price that is different from the requested price.

The difference between the expected fill price and the actual fill price is the “slippage”.

Whenever you are filled at a price different from the price requested, it’s called slippage.

Slippage isn’t necessarily something that’s negative because any difference between the intended execution price and actual execution price qualifies as slippage.

Market prices can change quickly, allowing slippage to occur during the delay between a trade order being processed and when it is completed.

Slippage happens during high periods of volatility, such as during breaking news or economic data releases.

Under normal market conditions in forex, the major currency pairs will be less prone to slippage since they are more liquid.

The major currency pairs are EUR/USD, GBP/USD, USD/JPY, USD/CAD, AUD/USD, and NZD/USD.

You can protect yourself from slippage by placing limit orders and avoiding market orders.

Examples of Slippage

Let’s say you are trying to buy EUR/USD with a price of 1.1050.

So on your trading platform, you see the price of 1.1050 being displayed and click “Buy”.

So 1.1050 is the price that you wanted your buy order to be executed at.

The order is sent to the broker over your internet connection.

Upon receiving the order, the broker then has to check that you have sufficient funds to cover the new order.

This means checking that you enough free margin after factoring in any other open positions.

From the communication transfer to data processing, these steps all create a delay.

This means that from the time the broker sent the original quote, to the time the broker can fill the order, the live price may have changed.

Slippage Types

The difference in the quoted price and the fill price is known as slippage.

The final execution price vs. the intended execution price will have one of three outcomes: no slippage, positive slippage, or negative slippage.

-> No Slippage

The order is submitted, and the best available buy price being offered is 1.1050 (exactly what you requested), the order is then filled at 1.1050.

-> Positive Slippage

The order is submitted, and the best available buy price being offered suddenly changes to 1.1045 (5 pips below your requested price), the order is then filled at this better price of 1.1045.

-> Negative Slippage

The order is submitted, and the best available buy price being offered suddenly changes to 1.1057 (7 pips above your requested price), the order is then filled at this price of 1.1057.

What Causes Slippage?

How does slippage occur and why can’t your orders be filled at the requested price?

A market consists of buyers and sellers.

For every buyer who wants to buys at a specific price and specific quantity, there must be an equal number of sellers who want to sell at the same specific price and same quality.

If there isn’t, there is an imbalance between buyers and sellers.

This is what causes prices to fluctuate and move up or down.

For example, if you want to buy EUR/USD at 1.1050, but there aren’t enough people willing to sell euros at 1.1050, your order will need to look for the next best available price.

That price must be higher (since there were no sellers at 1.1050), and this is what causes negative slippage. Let’s say that your order was filled at 1.1053. You experienced a negative slippage of 3 pips.

On the other hand, if there are a lot of people willing to sell their euros, your order might find a seller willing to sell at a price lower than 1.1050, such as 1.1048.

If your order is filled, then you were able to buy EUR/USD at 2 pips cheaper than you wanted. This is positive slippage.

For example, you bought EUR/USD at 1.1050, and have a stop-loss order at 1.1030. All of a sudden, aliens attack Europe, and EUR/USD plummets. Your stop loss gets hit but you see that your fill price was 1.0930!

You experienced a negative slippage of 100 pips! ????

Why Does Slippage Matter?

Slippage matters because you can end up receiving unfair execution prices.

The broker can make a riskless profit off you.

For example, let’s say you want to trade GBP/USD.

Your broker quotes you 1.3085 (bid) and 1.3090 (ask).

When you send a market order, you expected o buy when the ask price was at 1.3090.

Due to order handling delays, let’s say the market has moved down to 1.3080.

The broker can now fill the order at 1.3080…

BUT you had requested to buy at 1.3090.

So the broker buys GBP/USD at 1.3080 and then sells to you at 1.3090, making a riskless profit of 10 pips on your order!

As the trader, you have no clue that the price has changed. You just see your buy order execute at 1.3090 which was the price at which the order was placed.

Requotes

Rather than filling an order at a different price, some brokers do what’s known as requoting.

This is a situation when a broker is unable or unwilling to fill an order at the price requested by you, it sets an execution delay and returns the request with a different quote, often less favorable to you.

If the market has moved by a certain limit, the broker will send you a new price. This is a “re-quote“.

You’ll then have the choice to trade at the new price.

Of course, there’s no guarantee that the new order will fill either. You might receive another requote.

This frequently happens if the market is moving quickly, like during important economic data releases or central bank press conferences.

By the time your broker gets the order, the market will have moved too fast to execute at the price shown.

The requote notification appears on your trading platform letting you know the price has moved and gives you the choice of whether or not you are willing to accept that price.

Most of the time requotes typically occur on very large trades.

If your broker can’t execute your order immediately, there can be a significant price variation, even if only a couple of seconds have passed.

Requoting might be frustrating but it simply reflects the reality that prices are changing quickly.

That said, if requotes happen in quiet markets or you experience them regularly, it might be time to switch brokers.

If this article seems useful to your then please click the like button below. You can also share your valuable feedback or ask questions in the below comment section. Also, subscribe to our newsletter for trading-related updates.