A resistance level is a concept in technical analysis, indicating when an asset has reached a price level that market participants are unwilling to continue buying, which causes the price to stop rising.

Resistance is a price level at which upward movement may be restrained by accumulated supply at or around that price level.

Resistance, or a resistance level, is the price level at which the rise in price is halted by the emergence of a growing number of sellers who wish to sell at that price.

More and more sellers will be active the closer the price gets to the resistance level.

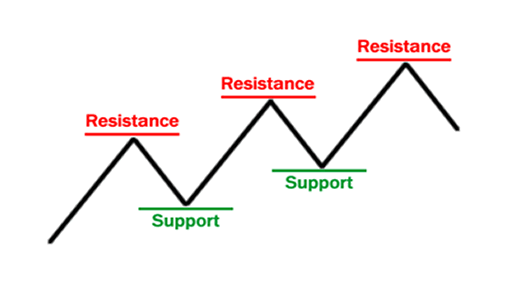

Resistance levels are often used in conjunction with support levels or the point at which traders are unwilling to let an asset’s price drop much lower.

Traders will often identify areas of support and resistance in order to make decisions on trades, including when to place stop losses and profit targets.

If an asset does break through its resistance level, then some traders believe it will carry on rising in price, or “rally“, until a new resistance level is found.

If this article seems useful to your then please click the like button below. You can also share your valuable feedback or ask questions in the below comment section. Also, subscribe to our newsletter for trading-related updates.