A dead cat bounce is a small, brief recovery in the price of a declining asset.

The phrase “dead cat bounce” is used to describe a brief recovery in the price of a declining asset that is shortly followed by a continuation of the downtrend.

The phrase comes from the saying, “Even a dead cat will bounce if it falls from a great height.”

This phrase originated on Wall Street and was popularly applied to situations where one can see a small comeback during a major decline.

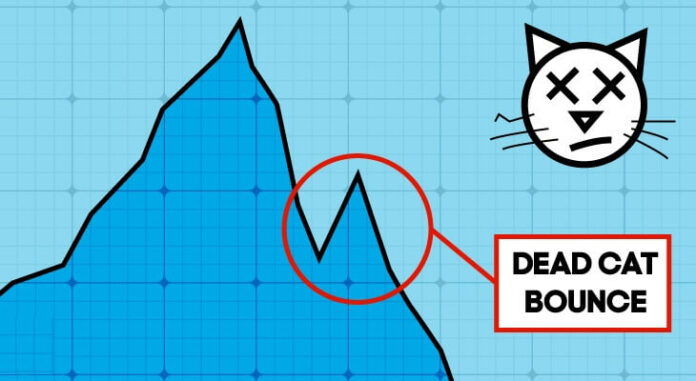

In technical analysis, a “dead cat bounce” is seen as a price continuation pattern.

During the initial stages of a Dead Cat Bounce pattern, it might be confused with a trend reversal.

It begins with a downward move followed by a significant price retracement.

However, after some time, the price stops rising, and the downward trend continues, breaking previous support levels and creating new lows.

As such, Dead Cat Bounce patterns may also result in what is called a bull trap, where traders open long positions and hope for a trend reversal that never happens.

The earliest usage of the phrase is in an article by Chris Sherwell in The Financial Times, December 7, 1985:

If this article seems useful to your then please click the like button below. You can also share your valuable feedback or ask questions in the below comment section. Also, subscribe to our newsletter for trading-related updates.