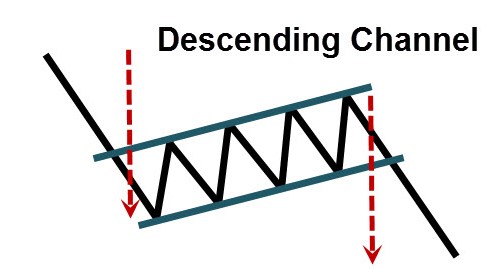

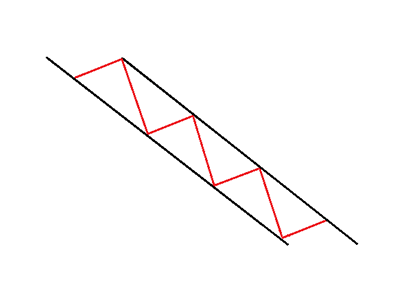

A descending channel is a chart pattern formed from two downward trendlines drawn above and below a price representing resistance and support levels.

The descending channel pattern is also known as a “falling channel” or “channel down“.

The upper line is identified first, as running along with the highs, and is called the trendline.

The lower line (the “channel line”) is identified as parallel to the trendline, running across the bottom.

It is a bearish chart pattern defined by a trend line supporting the series of lower lows and a diagonal resistance level connecting the lower highs.

When in the channel, prices are expected to bounce off both upper and lower boundaries. The more such reversals occur, the more reliable the pattern.

A descending channel looks similar to the Rectangle pattern, but the difference is that the descending channel slopes down.

A descending channel is the exact opposite of the ascending channel.

When the price is around the upper trend line, look for short opportunities, although aggressive traders could trade long and/or short at both trend lines looking for a bounce or pullback.

Another way to trade this pattern is to wait for the price to break through either trendline.

A break out above the upper trendline generates a strong buy signal, while a break down below the lower trendline generates a strong sell signal.

When the price breaks through the trend line (upper line), it might indicate a significant change in trend.

Breaking through the channel line (lower line), in contrast, suggests an acceleration of the existing trend.

Keep in mind that just like all the other patterns, channels might be prone to false or premature breakouts, which means that price may retreat back into the channel.

Descending channels are useful due to their ability to predict overall changes in trends.

Descending channels, like ascending channels, are a tool for determining whether the trend in price will continue.

As long as prices remain within the descending channel, the downward trend in price can be expected to continue.

Another strategy of using a descending channel is to identify where the price fails to reach the lower line.

The failure to reach it often signifies trend exhaustion. This could be an early warning that the trend is going to reverse. The breach of the trend line may be more likely to happen.

Descending channels often appear within an overall uptrend in prices, and represent either a continuation of the trend or a reversal of the trend.

The direction of the break will determine whether it’s a continuation or a reversal.

If this article seems useful to your then please click the like button below. You can also share your valuable feedback or ask questions in the below comment section. Also, subscribe to our newsletter for trading-related updates.