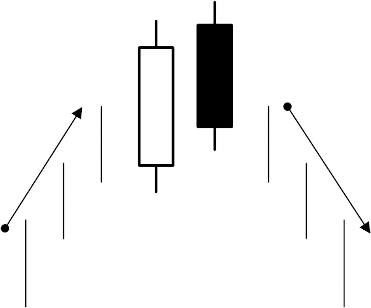

Dark Cloud Cover is a two-candlestick pattern that is created when a down (black or red) candle opens above the close of the prior up (white or green) candle, then closes below the midpoint of the up candle.

When you spot the Dark Cloud Cover pattern on a Japanese candlestick chart, expect a potential bearish reversal.

This candlestick pattern is easy to identify because its formation reflects its name.

At the end of an uptrend (a “sunny day”), a black candle appears (a “dark cloud“), signaling a trend reversal.

The Dark Cloud Cover pattern is the opposite of the Piercing pattern (which is a bullish reversal candlestick).

To identify a Dark Cloud Cover, look for the following criteria:

- A definite uptrend must be occurring.

- The pattern consists of two candles.

- The first candle in the pattern is an up or bullish candle (white or green).

- The second candle is a bearish candle (black or red) that must follow a bullish candle.

- The black candle must pass through the midpoint of the previous candle. It must open above the high of the previous candle, and it must close more than halfway down the body of the previous candle.

- Confirmation of the pattern is achieved when another black candle, of a smaller size, forms after the second candle.

Meaning

The Dark Cloud Cover pattern can be summarized by imagining a dark cloud overtaking the sky on a bright, sunny day.

When you see a Dark Cloud Cover pattern, due to the uptrend that precedes it, that the bulls were in control.

The bulls continue to push forward after the open, and the price gaps up, but then the bears step in.

The price closes near the low of the day, and the uptrend ends.

If the bears continue to control the market on the next candle, a reversal is likely.

Here are some tips on analyzing a Dark Cloud Cover pattern when you see one:

- The higher the gap up is from the previous candle’s close, the bigger the reversal will be. This shows that the market was unable to sustain that high price level.

- The longer the white candle and black candle are, the more pronounced the reversal will be.

- The lower the black candle closes into the white candle, the stronger the reversal will be.

- If the volume is high on both candles relative to previous candles, the reversal is more likely to occur.

Make sure that the Dark Cloud Cover pattern you’re seeing is NOT a Bearish Engulfing pattern. They’re very similar in appearance.

If the second candle closes below the previous candle’s open, you have a Bearish Engulfing pattern, not a Dark Cloud Cover pattern.

If this article seems useful to your then please click the like button below. You can also share your valuable feedback or ask questions in the below comment section. Also, subscribe to our newsletter for trading-related updates.