- 1. What is Forex (FX)?

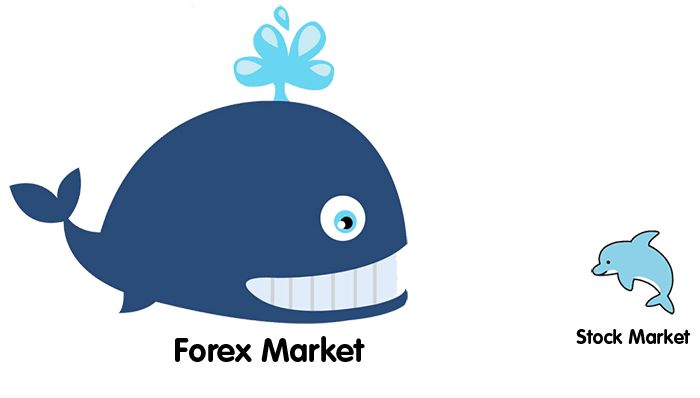

- 2. What is the forex market?

- 3. Three Types of Forex Markets

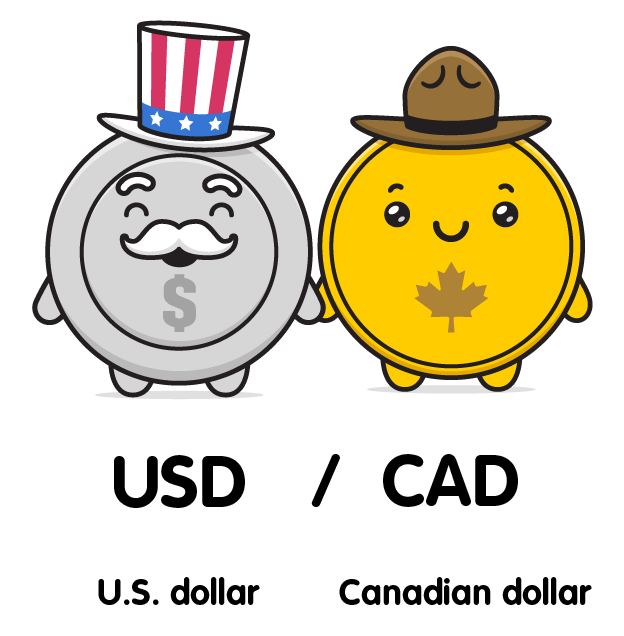

- 4. What is forex trading?

- 5. How to read a currency quote

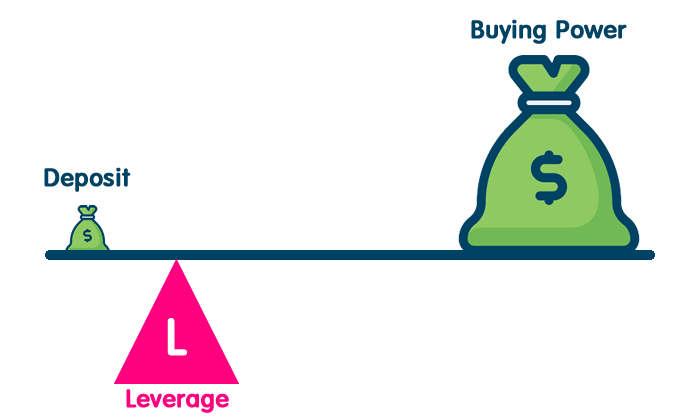

- 6. What is leverage?

- 7. What is Margin?

- 8. What is a pip?

- 9. What is the spread?

- 10. What is a lot?

- 11. How is the forex market regulated?

- 12. Why trade forex?

Forex stands for “foreign exchange” and refers to the buying or selling of one currency in exchange for another.

While it is called “foreign” exchange, this is just a relative term. The terms “foreign” and “domestic” are relative to the person using the term.

What is foreign to someone is considered domestic to another.

“Currency exchange” would be a more appropriate term.

The forex (also known as “foreign exchange” or “FX”) market is a global marketplace where currencies are traded and where exchange rates for every currency are determined.

What is Forex (FX)?

It is a decentralized or over-the-counter (OTC) market that involves all aspects of buying, selling, and exchanging currencies.

In terms of trading volume, the forex market is the largest market in the world, with an average daily trading volume of $6.6 trillion.

Currency trading was very difficult for individuals prior to broadband internet. Most currency traders were large multinational corporations, hedge funds, or high-net-worth individuals (“HNW”) because trading currencies required a lot of capital.

Once high-speed internet became more affordable to more people, a retail market aimed at individual traders emerged, providing easy access to the foreign exchange markets.

Forex trading platforms now offer very high leverage to individual traders who can control a large trade with a small account balance.

What is the forex market?

With over $5 trillion traded in the market every day, the forex market is the largest in the world.

The forex market is open 24 hours, 5.5 days a week from late Sunday to Friday.

It opens Sunday at 5:00 pm ET and closes Friday at 5:00 pm ET.

Trading begins with the opening of the market in New Zealand. And continues as more financial centers open: Sydney, Singapore, Hong Kong, Tokyo. Zurich, Frankfurt, Paris, London, and finally, New York City.

As the trading day in the U.S. ends, the forex market starts again in Auckland, New Zealand.

Unlike other markets (like the stock market), this means that currencies are being traded at all times, day or night.

What makes this “round-the-clock” trading possible is because there is no central marketplace for foreign exchange.

Since institutional currency trading takes place directly between two parties (bilateral transactions) in an over-the-counter (OTC) market, this means that there are no centralized exchanges.

Instead, the forex market run by a global network of banks and other organizations.

This means that all transactions occur via computer networks between traders around the world (instead of on one centralized exchange).

Most traders speculating on forex prices do not take delivery of the currency itself. They do not want a truckload full of euros delivered to their front door.

Instead, traders will make exchange rate predictions to take advantage of the price movements in the market.

The most popular way of doing this is by trading derivatives, such as a rolling spot forex contract.

Trading derivatives allow you to speculate on an asset’s price movements without taking ownership of that asset.

For example, when trading forex, you can predict the direction in which you think a currency pair’s price will move. The extent to which your prediction is correct determines your profit or loss.

Three Types of Forex Markets

There are three different ways to trade on the forex market: spot, forward, and future.

- Spot forex market: the physical exchange of a currency pair, which takes place at the exact point the trade is settled – ie ‘on the spot’ – or within a short period of time. Derivatives based on the spot forex market are offered over-the-counter.

- Forward forex market: a contract traded OTC that is agreeing to buy or sell a set amount of a currency at a specified price, and to be settled at a set date in the future or within a range of future dates.

- Futures forex market: a contract traded on an exchange to buy or sell a set amount of a given currency at a set price and date in the future.

Forex trading in the spot market has always been the largest market because it is the “underlying” asset that the forwards and futures markets are based on.

In the past, the futures market was the most popular venue for traders because it was available to individual currency traders for a longer period of time.

But with the arrival of broadband internet, faster and cheaper computers, online trading became more accessible and affordable, and along came retail forex brokers.

Since then, the spot market has grown exponentially and has overtaken the futures market as the preferred trading market for individual currency traders.

The spot market is where currencies are bought and sold according to the current price.

That price, determined by supply and demand, is a reflection of many things, including current interest rates, economic performance, politics (domestic and international), as well as the future performance expectations of one currency against another.

When a deal is finalized, this is known as a “spot deal.”

It is a bilateral transaction by which one party gives an agreed-upon currency amount to the other party (the “counterparty”) and receives a specified amount of another currency at the agreed-upon exchange rate value. After a position is closed, the settlement is in cash.

Although the spot market is commonly known as one that deals with transactions in the present (rather than the future), these trades actually take two days for settlement.

Unlike the spot market, the forwards and futures markets do not trade actual currencies. Instead, they deal in contracts that represent claims to a certain currency type, a specific price per unit, and a future date for settlement.

In the forwards market, contracts are bought and sold OTC between two parties, who determine the terms of the agreement between themselves.

In the futures market, futures contracts are bought and sold based upon a standard size and settlement date on public commodities markets, such as the CME Group.

In the U.S., the National Futures Association regulates the futures market. Futures contracts have specific details, including the number of units being traded, delivery and settlement dates, and minimum price increments that cannot be customized. The exchange acts as a counterparty to the trader, providing clearance and settlement.

Both types of contracts are binding and are typically settled for cash at the exchange in question upon expiration, although contracts can also be bought and sold before they expire.

The forwards and futures markets are used by big international corporations to hedge against future exchange rate fluctuations, but currency speculators take part in these markets as well.

What is forex trading?

Forex trading is the simultaneous buying of one currency and selling another.

When you trade in the forex market, you buy or sell in currency pairs.

Each currency in the pair is listed as a three-letter code.

The first two letters stand for the country (or region), and the third letter standing for the currency itself.

For example, USD stands for the US dollar and CAD for the Canadian dollar

In the USD/CAD pair, you are buying the U.S. dollar by selling the Canadian dollar.

How to read a currency quote

The first currency listed in a forex pair is called the base currency, and the second currency is called the quote currency (also known as the “counter currency“).

The price of a forex pair is how much one unit of the base currency is worth in the quote currency.

For example, for the currency “EUR/USD”, EUR is the base currency and USD is the quote currency.

If EUR/USD is trading at 1.1080, then one euro is worth 1.1080 U.S. dollars

If the euro rises against the dollar, then a single euro will be worth more dollars and the pair’s price will increase. If it drops, the pair’s price will decrease.

If you think that the base currency in a pair is likely to strengthen against the quote currency, you can buy the pair (“go long”).

If you think it will weaken, you can sell the pair (“go short”).

What is leverage?

Leverage allows you to increase your exposure to a financial market without having to commit as much capital.

When trading forex, you have the ability to open a position on leverage.

When trading with leverage, you don’t need to pay the full value of your trade upfront. Instead, you put down a small deposit, known as margin.

But when you close a leveraged position, your profit (or loss) is based on the full size of the trade.

This means that leverage can magnify your profits, but it also magnifies your losses.

Your losses can even exceed your initial deposit!

When trading with leverage, it is crucial that you learn how to manage your risk.

What is Margin?

Margin is a key part of leveraged trading.

Margin is the term used for the initial deposit you put up to open and maintain a position.

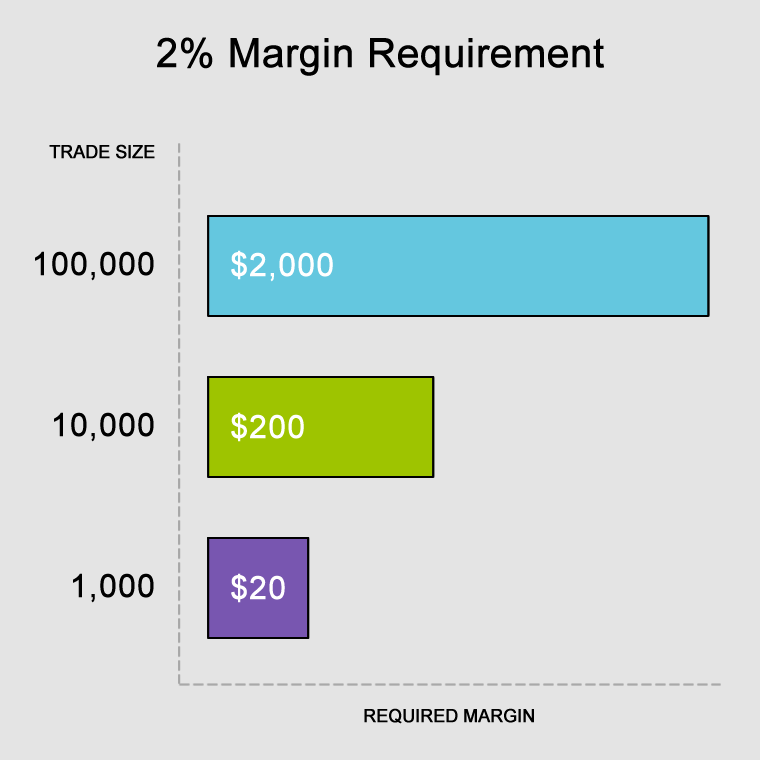

When you are trading forex with margin, remember that your margin requirement will change depending on your broker, and how large your trade size is.

Margin is usually expressed as a percentage of the full position.

For example, to open one min lot position (10,000 units) on EUR/USD, you might only require a deposit of 2% of the total value of the position for it to be opened.

This means that while you are still risking $10,000, you’d only need to deposit $200 to get the full exposure.

Do you feel overwhelmed by all this margin jargon? Check out our lessons on margin in our Margin 101 course that breaks it all done nice and gently for you.

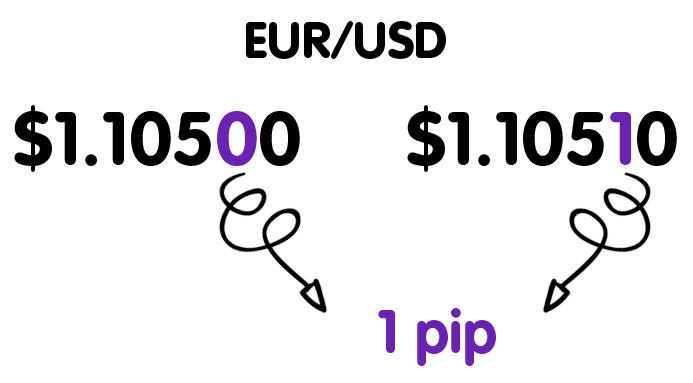

What is a pip?

Pips are the units used to measure movement in a forex pair.

A forex pip usually refers to a movement in the fourth decimal place of a currency pair.

For example, if EUR/USD moves from $1.10500 to $1.10510, then it has moved a single pip.

The decimal places that are shown after the pip are called pipettes, fractional pips, or “micro pips”, and represent a fraction of a pip.

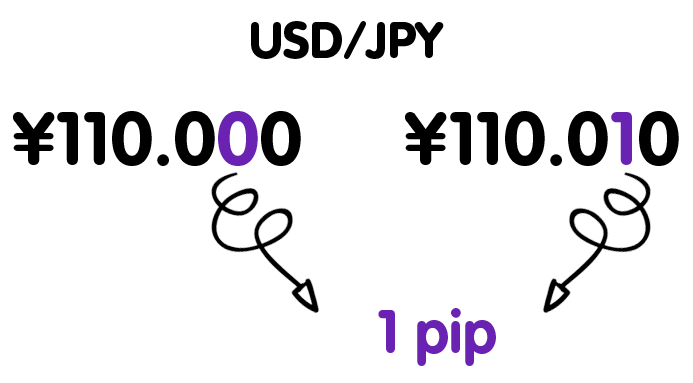

The exception to this rule is when the quote currency is listed in much smaller denominations, with the most common example being the Japanese yen.

In this case, a movement in the second decimal place constitutes a single pip.

For example, if USD/JPY moves from ¥110.00 to ¥110.01, it has moved a single pip.

What is the spread?

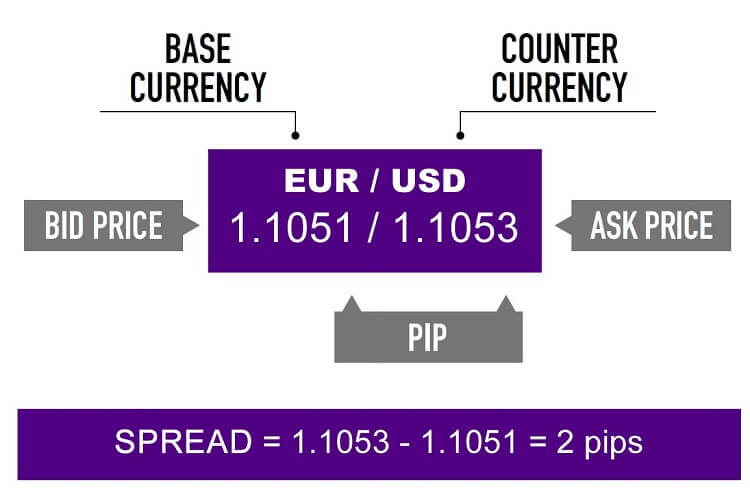

All forex quotes are quoted with two prices: the bid and ask.

If you want to buy, you use the ask price.

If you want to sell, you use the bid price.

So “ask = buy” and “sell = bid”.

In forex trading, the spread is the difference between the buy and sell prices quoted for a forex pair.

For example, if the buy price (the “ask”) on EUR/USD was 1.1053 and the sell price (the “bid”) was 1.1051, the spread would be two pips.

If you want to open a long position, you trade at the buy price, which is slightly above the market price.

If you want to open a short position, you trade at the sell price, which slightly below the market price.

What is a lot?

Currencies are traded in lots, which are batches of currency used to standardize the quantity for forex trades.

In forex trading, a standard lot is 100,000 units of currency. There are also smaller sizes available, known as mini lots and micro-lots, worth 10,000 and 1000 units respectively.

| LOT | NUMBER OF UNITS |

| Standard | 100,000 |

| Mini | 10,000 |

| Micro | 1,000 |

If these lots are too tiny for you, you can also trade a “yard” which is a billion units (1,000,000,000).

How is the forex market regulated?

How do you regulate a market that is trading 24 hours a day, all over the world?

Despite the enormous size of the forex market, there is no global regulation since there is no governing body to police it 24/7.

There is no centralized body governing the forex market.

Instead, there are governmental and independent bodies around the world that supervise domestic forex trading, as well as other markets, to ensure that all forex providers adhere to certain standards.

The regulatory bodies regulate forex by setting standards that all forex brokers under their jurisdiction must comply with.

These standards include being registered and licensed with the regulatory body, undergoing regular audits, communicating certain changes of service to their clients, and more.

This helps ensure that forex trading is ethical and fair for all involved.

In the U.S., the two primary regulatory agencies responsible for regulating the forex market are the Commodities Futures Trade Commission (CFTC) and the National Futures Association (NFA).

Why trade forex?

The forex market is unique due to its

- Huge trading volume, representing the largest asset class in the world leading to high liquidity

- Geographical dispersion

- Continuous operation: 24 hours a day except for weekends

- Variety of factors that affect currency exchange rates

- Use of high leverage to enhance profit and losses relative to account size

If this article seems useful to your then please click the like button below. You can also share your valuable feedback or ask questions in the below comment section. Also, subscribe to our newsletter for trading-related updates.