What is leverage?

We know we’ve tackled this before, but this topic is so important, we felt the need to discuss it again.

For example, to control a $100,000position, your broker will set aside $1,000 from your account. Your leverage, which is expressed in ratios, is now 100:1.

You’re now controlling $100,000 with $1,000.

Let’s say the $100,000 investment rises in value to $101,000 or $1,000.

If you had to come up with the entire $100,000 capital yourself, your return would be a puny 1% ($1,000 gain / $100,000 initial investment).

This is also called 1:1 leverage.

Of course, I think 1:1 leverage is a misnomer because if you have to come up with the entire amount you’re trying to control, where is the leverage in that?

Fortunately, you’re not leveraged 1:1, you’re leveraged 100:1.

The broker only had to put aside $1,000 of your money, so your return is a groovy 100% ($1,000 gain / $1,000 initial investment).

Now we want you to do a quick exercise. Calculate what your return would be if you lost $1,000.

If you calculated it the same way we did, which is also called the correct way, you would have ended up with a -1% return using 1:1 leverage and a WTF! -100% return using 100:1 leverage.

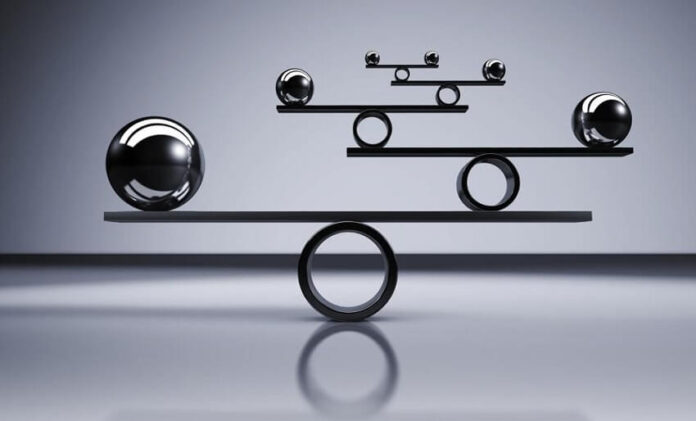

You’ve probably heard the good ol’ clichés like “Leverage is a double-edged sword.” or “Leverage is a two-way street.”

As you can see, these clichés weren’t lying.

If this article seems useful to your then please click the like button below. You can also share your valuable feedback or ask questions in the below comment section. Also, subscribe to our newsletter for trading-related updates.