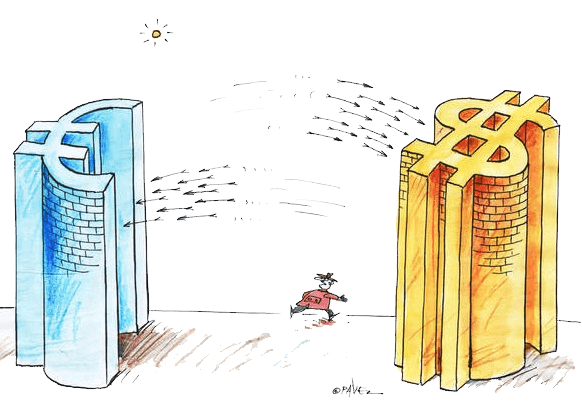

Forex trading is a currency BUY and an ongoing process of SELL. This process is done through a broker / dealer and the trade is to be done against another currency. Example, Euro and U.S. Dollar is trading in currency pairs (EUR/USD) or, trading in British Pound and Japanese Yen (GBP/JPY).

When you trade in the forex market, you buy or sell in currency pairs.

Suppose every currency pair is in a war. Of the two currencies, two want one currency to hold its own against the other currency. Which we have tried to show through the image above. Changes in the EXCHANGE RATE between these two currency pairs will depend on which currency pair is stronger at this time.

Major currency pair

The currency pairs listed in the chart below are called Major Currency Pairs

One of these pairs is in the U.S. Dollar (USD), which is the largest trading volume in the Forex market. In a word, these currency pairs are the most traded by traders.

| Currency Pair | Countries | FX Geek Speak |

|---|---|---|

| EUR/USD | Eurozone / United States | “euro dollar” |

| USD/JPY | United States / Japan | “dollar yen” |

| GBP/USD | United Kingdom / United States | “pound dollar” |

| USD/CHF | United States/ Switzerland | “dollar swissy” |

| USD/CAD | United States / Canada | “dollar loonie” |

| AUD/USD | Australia / United States | “aussie dollar” |

| NZD/USD | New Zealand / United States | “kiwi dollar” |

Major Cross-Currency Pairs or Minor Currency Pairs

Currency pairs that include the U.S. Dollar (USD) is not called cross-currency pair, it is called “crosses”.

Major Cross Payers are also more commonly known as “minors”. Most cross-currency pairing starts with three non-USD currencies: EUR, JPY, and GBP.

Euro Crosses

| Currency Pair | Countries | FX Geek Speak |

|---|---|---|

| EUR/CHF | Eurozone / Switzerland | “euro swissy” |

| EUR/GBP | Eurozone / United Kingdom | “euro pound” |

| EUR/CAD | Eurozone / Canada | “euro loonie” |

| EUR/AUD | Eurozone / Australia | “euro aussie” |

| EUR/NZD | Eurozone / New Zealand | “euro kiwi” |

| EUR/SEK | Eurozone / Sweden | “euro stockie” |

| EUR/NOK | Eurozone / Norway | “euro nockie” |

Yen Crosses

| Currency Pair | Countries | FX Geek Speak |

|---|---|---|

| EUR/JPY | Eurozone / Japan | “euro yen” or “yuppy” |

| GBP/JPY | United Kingdom / Japan | “pound yen” or “guppy” |

| CHF/JPY | Switzerland / Japan | “swissy yen” |

| CAD/JPY | Canada / Japan | “loonie yen” |

| AUD/JPY | Australia / Japan | “aussie yen” |

| NZD/JPY | New Zealand / Japan | “kiwi yen” |

Pound Crosses

| Pair | Countries | FX Geek Speak |

|---|---|---|

| GBP/CHF | United Kingdom / Switzerland | “pound swissy” |

| GBP/AUD | United Kingdom / Australia | “pound aussie” |

| GBP/CAD | United Kingdom / Canada | “pound loonie” |

| GBP/NZD | United Kingdom / New Zealand | “pound kiwi” |

Other Crosses

| Pair | Countries | FX Geek Speak |

|---|---|---|

| AUD/CHF | Australia / Switzerland | “aussie swissy” |

| AUD/CAD | Australia / Canada | “aussie loonie” |

| AUD/NZD | Australia / New Zealand | “aussie kiwi” |

| CAD/CHF | Canada / Switzerland | “loonie swissy” |

| NZD/CHF | New Zealand / Switzerland | “kiwi swissy” |

| NZD/CAD | New Zealand / Canada | “kiwi loonie” |

Exotic Currency Pairs

This type of currency pair is made up of one major currency and the other with an emerging economy currency. For example, Brazil, Mexico, Hungary, Africa etc.

In the chart below, we have tried to give examples of some exotic currency pairs. One thing to note, these currency pairs are one-of-a-kind at Broker Veda and are not so widely traded as “majors” or “crosses” currency pairs. So, the spread of this kind of currency pair transactions is very high.

| Currency Pair | Countries | FX Geek Speak |

|---|---|---|

| USD/BRL | United States / Brazil | “dollar real” |

| USD/HKD | United States / Hong Kong | |

| USD/SAR | United States / Saudi Arabia | “dollar riyal” |

| USD/SGD | United States / Singapore | |

| USD/ZAR | United States / South Africa | “dollar rand” |

| USD/THB | United States / Thailand | “dollar baht” |

| USD/MXN | United States / Mexico | “dollar mex” |

| USD/DKK | United States / Denmark | “dollar krone” |

| USD/SEK | United States / Sweden | “dollar stockie” |

| USD/NOK | United States / Norway | “dollar nockie” |

| USD/RUB | United States / Russia | “dollar ruble” or “Barney” |

| USD/PLN | United States / Poland | “dollar zloty” |

It’s not unusual to see spreads that are two or three times bigger than that of EUR/USD or USD/JPY. So if you want to trade exotics currency pairs, remember to factor this in your decision.

G10 Currencies

The currency of the G10 is a total of 1 that is used to make the most transactions in the world. Also, because of the high volume of transactions through these four currencies, they are also called the most liquid currencies in Forex trading.

| Country | Currency Name | Currency Code |

|---|---|---|

| United States | dollar | USD |

| European Union | euro | EUR |

| United Kingdom | pound | GBP |

| Japan | yen | JPY |

| Australia | dollar | AUD |

| New Zealand | dollar | NZD |

| Canada | dollar | CAD |

| Switzerland | franc | CHF |

| Norway | krone | NOK |

| Sweden | krona | SEK |

| Denmark | krone | DKK |

BRIICS

BRIICS is the acronym coined for an association of five major emerging national economies: Brazil, Russia, India, Indonesia, China and South Africa.

Originally the first four were grouped as “BRIC” (or “the BRICs”). BRICs was a term coined by Goldman Sachs to name today’s new high-growth emerging economies.

BRIICS is the term used by the OECD, the rich-country think tank adds Indonesia and South Africa.

| Country | Currency Name | Currency Code |

|---|---|---|

| Brazil | real | BRL |

| Russia | ruble | RUB |

| India | rupee | INR |

| Indonesia | rupiah | IDR |

| China | yuan | CNY |

| South Africa | rand | ZAR |

If this article seems useful to your then please click the like button below. You can also share your valuable feedback or ask questions in the below comment section. Also, subscribe to our newsletter for trading-related updates.